EIGHT STEPS TO DO AFTER LOSING YOUR WALLET

Losing your wallet can be absolutely terrifying! Who hasn’t experienced that heart-pounding panic when a wallet or purse is missing? Most likely, your wallet contains your entire life history: your credit cards, debit cards, your photo ID, insurance cards, library card, family photos, money. Do these eight steps after losing your wallet and help prevent a potential financial catastrophe!

Check To See If Your Wallet Lost, Stolen or Misplaced?

Before you panic, make sure your wallet is actually missing. Check your desk, your bag, your car or other places where you might have left your wallet. Retrace your steps and call if you can places you’ve been recently. There are good people in the world. If you’ve left your wallet at a restaurant, someone might have turned it in for you. Once you’ve checked the most obvious places and you’re certain it’s gone, move on to the next step.

List Everything That Was In Your Wallet

Try to remember everything that you have in your wallet so you know all the places you may need to contact. This may include keys, work ID cards, library card, coupons, etc. You’re more likely to remember much of what was in your wallet soon after you’ve lost it so get out that pen and paper and write it all down.

Wiki How

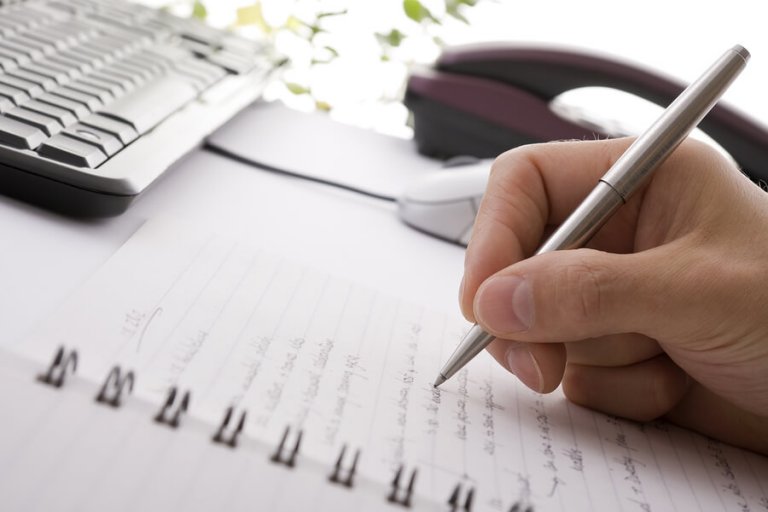

Call Your Bank and Credit Card Issuers

Call your bank and your credit card companies. Report that your cards are lost or stolen, and inquire if they offer services that may protect you against identity theft. In the digital age, protecting customers against identity theft is the best interest of you and those companies. Also, while you’re on the phone, ask about the process to have new cards sent to you as soon as possible with new account numbers. After you’ve received these new cards don’t forget to update any automatic pay withdrawals.

Handy Labors

Change Your Locks If Keys Are Missing

Some people carry spare keys to their homes or cars in their wallets. If you are one of those people, change your locks immediately!

Put Up A Fraud Alert And Freeze Your Credit Score

Contact the three major credit-reporting agencies: Experian, Trans Union and Equifax. Let the respective representatives know your wallet is lost or stolen. Also ask what else you can do to protect yourself against identity theft.

Report Your Lost Wallet To The Police

Reporting your lost wallet to the police will create a paper trail for the actions you have done since you lost your wallet. Most credit companies or banks will want to see that you have reported the loss; otherwise, they might be suspicious of whether you’re telling the truth.

Kezi.com

Notify Your Local DMV Of Your Missing Driver's License

Most likely if you’ve lost your wallet, you’ve also lost your driver’s license. Contact your local DMV and report your loss. If your license was about to expire, you may be able to renew your license rather than apply for a duplicate, which in some states might be an easier process. Remember not to drive anywhere until you’ve gotten your duplicate license.

Watch Out For Fraudlent Activity

Even if you’ve chosen to freeze your credit score, you should still monitor your credit score for suspicious activity. You are entitled from a free credit report from each major credit bureau. Check your credit score every four months just to be sure.